LUMS Launches Center for Digital Assets Research to Drive Blockchain Innovation in Pakistan

In a move that positions Pakistan at the forefront of digital asset innovation, LUMS has unveiled the Center for Digital Asset Research (CeDAR), a groundbreaking initiative aimed at advancing blockchain research, policy, and development in Pakistan. The new center aspires to be a hub of excellence in decentralised internet, Web 3.0, and digital asset technologies, providing a platform for research, education, and innovation.

CeDAR’s inauguration, which was marked by an international conference, highlights Pakistan's growing significance in the digital assets space. The high-profile event attracted global investors and thought leaders from the digital asset ecosystem, as well as key domestic stakeholders, including the State Bank of Pakistan (SBP), the Securities and Exchange Commission of Pakistan (SECP), and the Pakistan Banking Council.

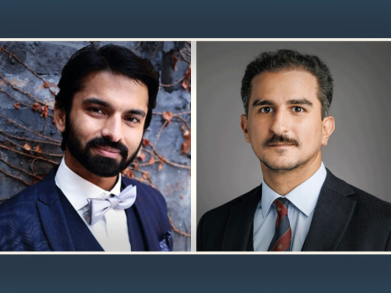

Supported by a generous grant from the Stacks Foundation, a key player in the Web 3.0 ecosystem, CeDAR is poised to lead efforts in blockchain research. Dr. Muneeb Ali (BSc ’03), a distinguished LUMS alumnus and co-founder of Stacks, delivered the keynote address at the event, where he emphasised the transformative potential of blockchain technologies, shedding light on how decentralised solutions can reshape finance.

Addressing the audience via video call, Dr. Ali shared insights into his journey from studying computer science at LUMS and Princeton to co-founding Stacks, where his work focuses on making Bitcoin—the largest global digital asset— programmable. He explained how this breakthrough allows Bitcoin to evolve from a passive asset to a productive one, capable of supporting decentralised applications and financial tools.

The event featured two insightful panel discussions moderated by alumnus Mr. Ali Farid Khawaja (BSc ’03), Financial Advisor, CeDAR, and Chairman, KTrade. Panellists included Dr. Najam Kidwai, Co-founder and CEO, C1 Group LLC; Mr. Mohammad Yesilhark, Co-founder, NOIA Capital; Mr. Faisal Aftab, Founder and CEO, Zayn VC; Mr. Daniel Holmes, Director of Business Development, Haruko; Mr. Sardar Ahmad Durrani, Head of Investments and Partnerships, GDA; Mr. Daniel Ahmed, CEO, Fasset; Mr. Ayad Butt, SEO, Zodia Markets; and Dr. Muneeb Ali, Co-founder, Stacks Foundation. Representatives from leading domestic fintech companies and venture capital firms such as Abhi Bank, KTrade, TPL, Brillianz Group, Alfalah Investments, Zayn VC, and NayaPay were also present.

Mr. Yesilhark, a seasoned global investor, explained his transition from traditional finance to digital assets by referencing a distorted market landscape where “$18 trillion of assets were trading at negative yields.” He highlighted that this shift represents a broader reimagination of finance, enabled by technology and accessible to innovators everywhere, including in Pakistan.

Mr. Kidwai, who has backed some of the world’s leading tech companies, noted that institutional capital is already flowing into the sector, stating, “Governments now see the value of regulated frameworks, especially with tools like stablecoins transforming remittances.” He added that digital assets are attractive due to their finite supply, resistance to inflation, and utility in emerging markets like Pakistan, particularly for remittances via stablecoins, which can offer zero fees and instant transactions.

Similarly, Mr. Aftab, a well-known investor in digital assets, emphasised how Bitcoin’s scarcity and deflationary nature provide a viable alternative to the global financial system, which has been burdened by excessive money printing and systemic instability.

“Pakistan has a unique opportunity,” he stated. “Digital assets can democratise finance, especially in countries where inflation is high and access to traditional banking is limited.”

At the conference, speakers highlighted the increasing mainstream adoption of digital assets, noting that 5% of the general population now holds crypto assets. One of the key themes of the conference was the need for a solid regulatory framework. Several speakers emphasised the example set by Dubai in fostering a crypto-friendly environment, suggesting that Pakistan could benefit from using digital assets as a strategic reserve and offering its citizens access to decentralised savings tools.

Additionally, panel discussions addressed the evolving landscape of tokenisation, noting that the process could transform financial markets and reduce the barriers to accessing high-value assets.

The importance of collaboration between academia, policy makers, and innovators was another key takeaway from the event. Speakers called for closer ties between universities like LUMS, government bodies, and the private sector to foster innovation in blockchain and digital asset technologies. Several experts echoed the need for comprehensive policy research, regulation, and education to build trust and promote wider adoption of digital finance in Pakistan.

The event also served as a platform for a candid discussion on risks and challenges, particularly in crypto mining and digital asset security. Panellists noted that while traditional finance remains deeply entrenched, the shift toward decentralised models offers significant opportunities for countries like Pakistan to leapfrog outdated systems.

Dr. Ali Cheema, Vice Chancellor of LUMS, also addressed the audience, highlighted Pakistan’s economic stagnation due to structural issues like low savings and investment, and proposed that decentralised technologies can help improve transparency, financial access, and governance.

“CeDAR's mission to use blockchain and decentralised technologies to help build an inclusive and forward-looking digital community aligns extremely closely with the university's mission, so we're extremely excited that this center is now taking shape and at a very pivotal moment,” Dr. Cheema said.

Unveiling the center’s logo, Mr. Shahid Hussain, Rector, LUMS, remarked on its significance as “a neutral space for people who are from this industry— regulators, legislators, policy makers and, of course, the academics.”

The conference concluded with a powerful message: Pakistan is on the brink of a transformative opportunity in digital assets, with the potential to be a leader in the space. With CeDAR now fully operational, LUMS will continue to shape education and research in Pakistan, unlocking opportunities for innovation that could transform the future of finance in the region.